Governance

Governance

Corporate governance is all about the way that Gasunie is run, about how management is supervised and how we render account. Good corporate governance is a precondition for effectiveness and efficiency in achieving the goals we have set ourselves. It ensures adequate risk management and careful consideration of the interests of all of Gasunie’s stakeholders.

Corporate governance at Gasunie

-

Shareholder

N.V. Nederlandse Gasunie (Gasunie) is a public limited company whose sole shareholder is the Dutch State, with the Ministry of Finance fulfilling the shareholder function.

-

Audit Committee

The Supervisory Board’s Audit Committee monitors and makes recommendations concerning the integrity and quality of the financial and sustainability reporting, the effectiveness of the design and operation of the internal risk management and control systems, and the company’s financing.

-

Remuneration, Selection & Appointment Committee

The Supervisory Board does not have a separate remuneration committee (best practice 2.3.2 of the Dutch Corporate Governance Code). Remuneration is covered by the combined Remuneration, Selection & Appointment Committee. This is justified by the fact that the remuneration policy for the Executive Board of Gasunie as a state-owned company is determined in close consultation with the Dutch Ministry of Finance. The last recalibration took place in 2021.

-

Executive Board

The Executive Board comprises four members, two of whom are members under the articles of association.

-

Supervisory Board

The Supervisory Board is tasked with monitoring the policy set by the Executive Board and with the general state of affairs. This board advises the Executive Board and sets the remuneration and terms of employment of the members. In accordance with the Dutch Gas Act and the articles of association, certain decisions to be made concerning GTS and other subsidiaries are also submitted for approval to the Supervisory Board.

-

Internal Audit

Internal Audit provides independent, objective assurance, insights and advice on governance, risk management, management control, internal control and business processes. The Internal Audit department does this for Gasunie’s business units and participating interests.

-

External auditor

The General Meeting mandated the Supervisory Board to select a new external auditor. Ernst & Young Accountants LLP has been appointed as external auditor starting from the 2023 financial year.

-

Document of Representation

The various business units and participating interests render account to the Executive Board using the Document of Representation, providing, over time, official feedback on the degree to which minimum requirements for management control have been complied with. These documents are discussed with the Supervisory Board every year.

-

Mitigated structure regime

N.V. Nederlandse Gasunie is subject to the mitigated structure regime. The governance structure is based on Book 2 of the Dutch Civil Code, the Dutch Corporate Governance Code, the company’s articles of association, and various internal rules of procedure. Various provisions affecting the governance of the company are also contained in the Dutch Gas Act.

-

Dutch Corporate Governance Code

Gasunie applies the provisions of the Dutch Corporate Governance Code (also called ‘the Code’). Although the Code is, strictly speaking, only applicable to listed companies, Gasunie follows the principles and best practice provisions of the Code insofar as they are relevant and applicable to Gasunie. The principles and provisions of the Code have for the most part been implemented in our articles of association and in various rules of procedure. An updated version of the Dutch Corporate Governance Code came into force in the 2023 financial year. Over the reporting year, Gasunie investigated whether it needed to make changes to its own governance structure to stay compliant with the updated Code. Where necessary and deemed relevant, the changes have now been implemented. Gasunie's website includes a 'comply or explain' overview regarding the application of the Corporate Governance Code.

-

Conflicts of interests

We comply with best practice provision 2.7.4 of the Dutch Corporate Governance Code, which stipulates that transactions involving conflicts of interests of members of the management board or supervisory board that are of material significance for the company or the relevant board member(s) must be disclosed in the management report. There were no transactions of this nature in 2023.

-

Independence

With the exception of one member, all Supervisory Board members satisfy the requirements of independence within the meaning of the Dutch Corporate Governance Code. Best practice provisions 2.1.7(i) and 2.1.8(iii) of the Dutch Corporate Governance Code apply to Supervisory Board member Anja Mutsaers. Additional arrangements have therefore been made to avoid any actual or perceived conflict of interests. In the opinion of the Supervisory Board, this satisfies the requirement of independence within the meaning of the Dutch Corporate Governance Code.

-

Quarterly meeting on social topics

Senior management discusses Gasunie’s progress in the area of broad prosperity and non-financial value creation every quarter in the quarterly meeting on social topics. This meeting is chaired by the CFO.

Diversity of Executive Board and Supervisory Board

Diversity is an explicit area of attention for Gasunie. The policy is aimed at ensuring Gasunie acts in accordance with the diversity requirements set out by law and in the Corporate Governance Code when filling future vacancies on the Executive Board and the Supervisory Board.

The Act to amend Book 2 of the Dutch Civil Code in connection with making the ratio between the number of men and women on the management board and supervisory board of large public and private companies more balanced came into effect in 2022.

The composition of the Executive Board meets the target (33.33%) for state-owned companies regarding having a balanced distribution of seats between men and women on the management board, with 33.33% of the seats held by women and 66.66% by men from 1 November 2023 to 29 February 2024 and 50% by women and 50% by men from 1 March 2024.

Up to 30 September 2023 the Supervisory Board consisted of six people, four men and two women, and thus met both the general target and the target under the articles of association for a balanced ratio between the number of men and women on the Supervisory Board. From October 2023 the Supervisory Board has comprised five members: three men and two women. One of the Supervisory Board members has German nationality.

Within ten months from the end of each financial year, Gasunie reports to the Social and Economic Council (SER) on (i) the number of men and women who are members of the Executive Board and the Supervisory Board at the end of the financial year, as well as those in particular categories of employees (to be determined by the company) in managerial positions; (ii) the targets (i.e. target figure); (iii) the plan to achieve these targets; and (iv) the reasons if one or more targets have not been achieved.

- Rules of procedure governing the principles and best practices of the Executive Board

- Rules of procedure governing the principles and best practices of the Supervisory Board

- Gasunie Safety Speak Up scheme

- Conduct Guidelines – Working Together

- ‘Apply or explain’ overview in relation to application of the Dutch Corporate Governance Code

Governance and Management Control

Gasunie’s Governance and Management Control architecture is based on the Three Lines Model. The Executive Board has final responsibility for risk management and is accountable to the Supervisory Board and the General Meeting of Shareholders for this. The Supervisory Board regularly talks to individual members or the entire Executive Board about governance and management control, addressing things such as important risks and audit results. As a result, risk management is an activity that is performed at all levels of the organisation.

Governance and Management Control at Gasunie

Risk management

Key aspects of our risk management efforts are defining the risk appetite, running risk analyses at various levels in the company, and discussing the findings at various levels in the company. The corporate risk appetite and corporate risk analysis are detailed in the following.

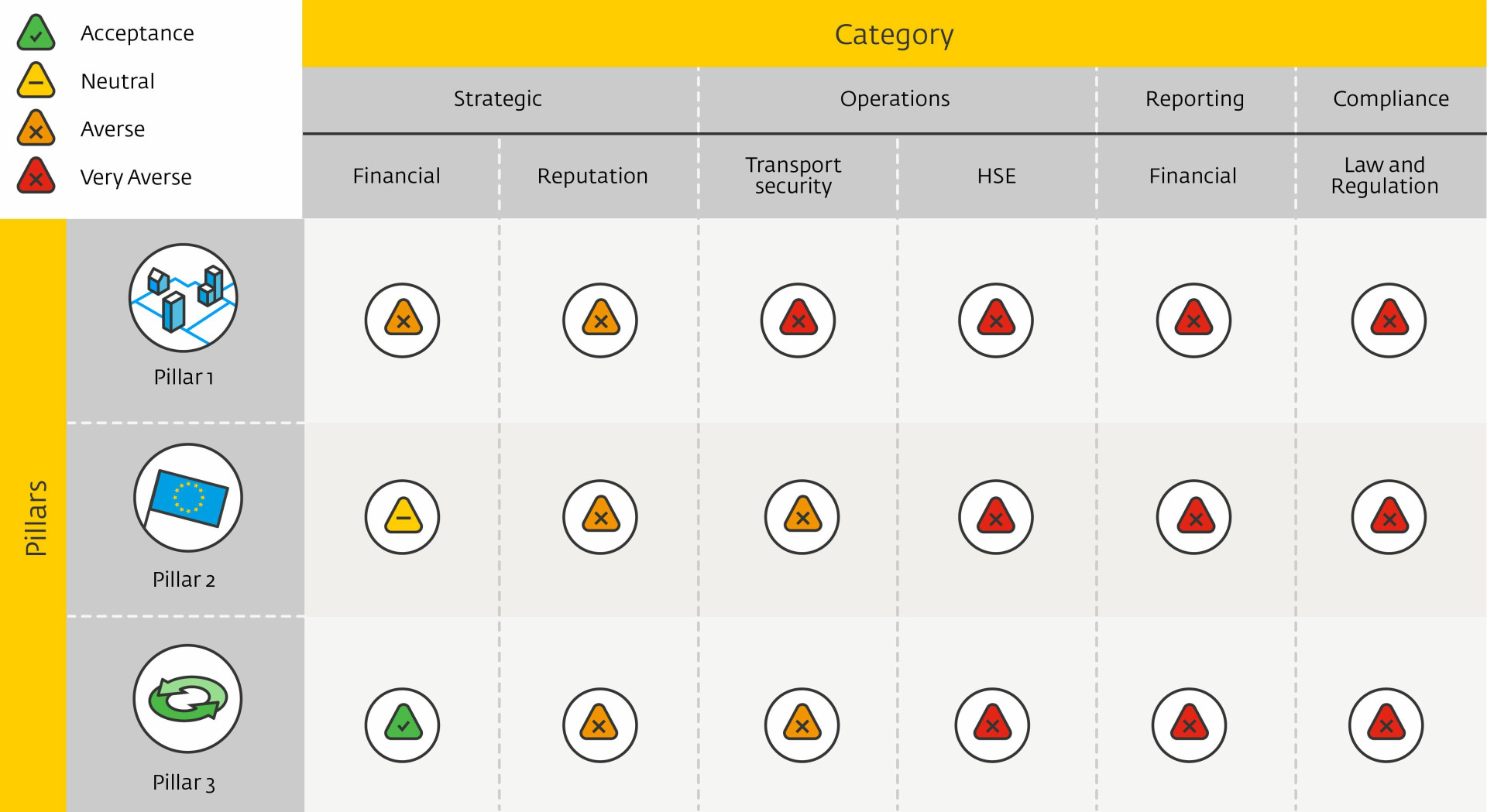

Every year, the Executive Board establishes the risk appetite with regard to the three pillars of the strategy. In so doing, we make a statement about the extent to which the organisation is prepared to accept risks relating to attaining its strategic objectives. We furthermore apply a number of general principles that cut across the strategic pillars and that we, as an organisation, must comply with at all times. Our risk appetite serves as a guideline in our strategic and operational decision-making.

Our general principles when it comes to risks

Changing view of risk

The dynamics we are seeing in the energy market are unprecedented. Gasunie feels responsible for facilitating the energy transition and increasing transmission security in times of climate change and geopolitical unrest. This means that we, as a company, are prepared to take greater risks, in certain areas, than previously.

Gasunie’s risk appetite

-

Pillar 1 Optimising infrastructure

The low regulated return in this first pillar goes hand in hand with a risk-averse financial profile. Funds must first be secured before strategic investment decisions are made.

-

Pillar 2 Connecting Europe

Financial risks relating to strategic investments are based on a generally acceptable balance between risk and return. Strategic investments are assessed on their public relevance, societal impact and contribution to supporting security of supply in Europe.

-

Pillar 3 Acceleration in the energy transition

An entrepreneurial approach is a prerequisite for creating value in the long term, which calls for a higher financial risk appetite for strategic investments. We are prepared to accept more uncertainty about the expected return for the sake of developing future business models that will have significant social impact.

In the We are Gasunie section we provide a summary of the strategic risks and opportunities for Gasunie on the way to 2050. The 2030-2050 Integrated infrastructure survey (II3050) drawn up jointly by the Dutch network operators, as well as the conclusions that Gasunie draws from this for itself form the basis for this. In the Additional information section, we present an overview of our key strategic and operational risks and the measures we take to manage these risks.

Risk assessments

Risk instruments in Gasunie’s management control cycle

-

Corporate Risk Analysis (CRA)

Through an annual CRA, we analyse the main strategic risks that could stand in the way of the implementation of our strategy in the medium to long term and the main strategic opportunities that could positively affect the execution of our business processes. The CRA is an integral part of our corporate business plan, which has a three-year horizon and we update every year.

-

Business Risk Analysis (BRA)

For our business units and service providers, each year we run a BRA. This analysis looks at (i) corporate risks and opportunities assigned to the business unit or service provider in question; and (ii) risks that are specific to the business unit or service provider in question. The BRA looks at short to medium term risks that could impact the achievement of objectives and is an integral part of our business plans.

-

Process review

Process owners conduct an annual process review. They run down a checklist to assess whether they are in control and whether there are opportunities for improvement. The process owner is supported in this by the process manager and other experts. If it emerges from the process review that it would be a good idea to gain more insight into possible risks, for example because the context of the process has changed, then we start an Operational Risk Analysis (ORA).

-

Operational Risk Analysis (ORA)

We conduct operational risk analyses of business processes. We record the results of ORAs in the internal reports and audit plans of the departments involved in these processes.

-

Internal Control Plans (ICPs)

Any mitigating measures taken to control risks identified by operational risk analyses must be tested for effectiveness. We do so through internal control plans.

Report from the Supervisory Board

Geopolitically and socially, 2023 was once again a turbulent year. As in 2022, the change in the gas flows that has come about due to the war in Ukraine and the efforts required to achieve the international climate targets have had a major impact on Gasunie’s organisation, activities and workload as well as on employees’ work experience. We are proud that the Executive Board and all Gasunie employees have put their heart and soul into reducing the impact of the war on the gas market over the past year while still making it possible to take firm steps towards achieving the international climate targets.

The key topics in 2023

Plan implementation in 2023

Implementation of the 2023 business plan was monitored and discussed on a quarterly basis during the regular consultations between the Supervisory Board and the Audit Committee. After a remarkable 2022, 2023 was characterised by more stability. Though energy prices were still higher than they had been in the past, they were considerably less volatile. Various adjustments were made to the gas infrastructure to support the changing gas flows. In the coming years, Gasunie wants to invest further to continue to meet the transmission security standards.

The Supervisory Board is pleased to note that Gasunie paid even more attention to the safe performance of all work activities in 2023, not only among Gasunie staff, but also with the contractors. Safety is also the top priority for the Supervisory Board. All the extra efforts made by Gasunie to carry out the work safely have resulted in fewer workplace injuries than in 2022. We will continue to ensure that Gasunie strives for a workplace without safety incidents in 2024 as well.

The Supervisory Board approved a number of decisions in 2023. In addition to investments in the regulated domain (network connections), these were final investment decisions for Porthos CO2 storage and transport, for the expansion of Gate terminal, and for the hydrogen transmission network in Rotterdam as the starting point of the national hydrogen transmission network. The progression of the Porthos project and the hydrogen transmission network in Rotterdam into the development and construction phase is a new milestone in Gasunie’s contribution to achieving the international climate targets. We have furthermore approved preparation budgets for hydrogen storage by Hystock, offshore hydrogen transmission, CO2 transport and import by Aramis and CO2Next, and the transfer of 50% of the shares in EemsEnergyTerminal to Vopak.

Contribution towards security of supply

The Russian invasion of Ukraine at the end of February 2022 had a direct impact on Gasunie’s activities. In 2023, the Supervisory Board had the Executive Board give it regular updates on developments concerning Gasunie’s contribution to security of supply, including the phased commissioning of the nitrogen plant in Zuidbroek, GTS’ advice to the Ministry of Economic Affairs and Climate Policy about security of supply and the availability of the Groningen gas field, and the deployment of the temporary LNG terminal at the port of Eemshaven, the expansion of LNG capacity at Gate terminal in the Port of Rotterdam, and the development of the LNG terminal in Brunsbüttel.

We are pleased that, after delays in the construction process, the nitrogen plant in Zuidbroek has been commissioned (in phases) and was able to convert sufficient foreign gas to ‘Groningen quality’ in time for the 2023/24 winter. The delays were caused to a large extent by the Covid-19 crisis and delays in the supply of building materials and building components, along with the main contractor and subcontractor not being able to see eye to eye. In 2023, in good collaboration with the Executive Board, we started evaluating the internal process of developing the nitrogen plant.

EemsEnergyTerminal has made a major contribution to security of supply by unloading more than 70 LNG tankers. The expansion of Gate terminal with a fourth LNG tank, approved by the Supervisory Board, and the successful sale of the existing Gate terminal capacity have also contributed to ensuring a sufficient supply of gas to north-western Europe.

2024-2026 business plan

The 2024-2026 business plan is largely devoted to successfully realising the Vision 2030 plans and projects and to Gasunie’s contribution to achieving the international climate targets and those from the Dutch Climate Agreement. Investments in this scenario total approximately € 11.5 billion up to 2030. In addition, the financial effects and uncertainties of the regulatory regime are visible, which has resulted in significant regulatory settlements.

In July 2023, the Dutch Trade and Industry Appeals Tribunal ruled in favour of GTS on a large number of grounds in extensive legal proceedings against the financial regulation of the regulatory authority ACM. This ruling is very significant for GTS, and for Gasunie as a whole. The ruling has made it clear that the transparency and explainability requirements are the same for all parties involved in the regulatory process. In the short term, the ruling will allow GTS to better cover its costs. For the longer term, the court has attached a number of new conditions to the regulation of GTS that will improve its position, as well as that of other, future network operators within Gasunie, such as those for heat and hydrogen.

Successfully realising the Vision 2030 plans and projects would result in a transition pathway where the avoided emissions could rise up to as much as 25.6 megatonnes per year by 2030. The main contributors would be, once completed, the CO2 storage projects Porthos and Aramis, the Dutch hydrogen transmission network, and the green gas projects. A concrete picture of Gasunie’s efforts can be seen in the objectives, pace and investments along this transition pathway. This pathway is ambitious and the end destination can feasibly be reached (with a lot of effort). It is, however, a pathway with internal and external uncertainties – about the energy transition, whether projects can be completed, market acceptance, regulations, geopolitical developments, market prices, and so on.

Gasunie is transforming from a natural gas transmission system operator into an energy infrastructure company, operating in the area of integrated sustainable energy systems, with international connections and interests. This transformation is big. It is a transformation towards a brand new profile in terms of activities, geographics, financials, technology, knowledge and risks, a transformation in the content of the work the employees do and the company culture in which they do it. Gasunie is changing from being an organisation working in the background to facilitate the activities of others to a future-oriented, outward-oriented, decisive driver and essential part of the energy transition. As the Supervisory Board, we support Gasunie’s recognition of the urgency of the situation and its resolute spirit, and we endeavour to assist the Executive Board through our advisory and supervisory role.

Strategy review

In 2023, Gasunie started reviewing its mission, vision and strategy. The Supervisory Board and the shareholder are closely involved in this process, as are the Ministry of Economic Affairs and Climate Policy and other stakeholders. The process started with interviews of employees and stakeholders, which resulted in the identification of the key topics. Based on all the information collected, draft versions of the new mission and strategy were developed. The strategy review is expected to be completed by mid-2024.

Consultations with the Works Council

Individual members of the Supervisory Board attended two consultative meetings with the Works Council in 2023. All members of the Supervisory Board also spoke with the Works Council in the autumn. In various rounds of talks at various tables, ideas on Gasunie’s course and the associated challenges for the company were freely exchanged. Everyone considers this dialogue to be very useful.

Consultations with the shareholder

There were several informal meetings with representatives of the Ministry of Finance and two formal consultations, one in the spring and one in the autumn. As the shareholder, the Ministry played a crucial facilitating role in the decisions regarding the LNG capacity in the Netherlands and Germany, the Porthos project, and the agreements regarding the rollout of the hydrogen transmission network. There were frequent discussions with the shareholder about the considerations that Gasunie has to make with regard to risks, returns, and broad prosperity.

2023 financial statements

The Board discussed the 2023 annual report, and upon receipt of the positive recommendation given by the Audit Committee and the unqualified auditor’s report from the external auditor EY, it decided to submit the 2023 financial statements for adoption to the Annual General Meeting. In addition, the Supervisory Board supports the proposal of the Executive Board that from the net profit € 266 million be paid as dividend and that € 216,3 million be added to the other reserves.

Composition of the Executive Board

Effective 1 October 2023, after serving Gasunie as CEO for almost ten years, Han Fennema stepped down on his own initiative. Willemien Terpstra will succeed him on 1 March 2024, with Janneke Hermes serving as acting CEO until then. Ulco Vermeulen resigned as titular member of the Executive Board on his own initiative, effective 1 July 2023. He was succeeded by Hans Coenen, who took a seat on the Executive Board on 1 April 2023. We would like to take this opportunity to thank Han and Ulco for their exceptional commitment to Gasunie in turbulent times and for the pleasant collaboration we have enjoyed over the years. We are confident that we have found competent successors in Willemien and Hans and wish them every success.

Cooperation between the Supervisory Board and the Executive Board, and evaluations

Cooperation and interactions between the Supervisory Board and the Executive Board have been intensive this year. The Supervisory Board has observed that the growing investment portfolio and geopolitical developments are placing increasing demands on the Executive Board, the Supervisory Board and all Gasunie employees. The findings from the external evaluation carried out in 2022 were followed up in 2023 and, as a result, improved standard investment proposals have been developed and more attention has been paid to strategic risks and scenarios.

The performance of the Supervisory Board, the Audit Committee, the Remuneration, Selection & Appointment Committee and the individual members of the Supervisory Board is evaluated internally every other year; an evaluation is carried out under external guidance in the other years. The Supervisory Board conducted an internal evaluation in 2023 using questionnaires, feedback from board members, and performance dialogues between the members. The Supervisory Board also conducted an internal evaluation of the Executive Board and the individual Executive Board members through self-evaluation, assessment of the previously set targets, and individual interviews.

From the evaluation it emerged that the Supervisory Board and its committees all function well. The Supervisory Board members complement each other well in terms of knowledge, expertise and competencies, the collaboration is very pleasant, and together they have a very large network. Matters requiring attention brought to light by the evaluation include: the efficiency of the preparations and conduct of the meetings; the desired addition of knowledge and expertise after the resignation of Pieter Duisenberg; and the continuity of knowledge and experience in the area of large energy/energy transition projects. In the search for a new Supervisory Board member, attention is being paid to supplementing this knowledge and expertise. Furthermore, the large amount of time that the members of the RSAC in particular spend on their work is a matter requiring attention.

The Supervisory Board holds the view that the Executive Board’s performance and that of its individual members is good and aligned with the phase that Gasunie currently finds itself in. The conclusions of the evaluation were discussed with each board member individually. The Supervisory Board thanks the other members of the Executive Board for the extra effort they exerted in the period between the resignation of Han Fennema and the appointment of Willemien Terpstra and has great appreciation for the way in which the Executive Board has dealt with the external and internal challenges.

Composition of the Supervisory Board and meetings

Dirk Jan van den Berg resigned after two terms, effective 29 March 2023. Pieter Duisenberg stepped down on his own initiative on 1 October 2023 to take up his new position as President of the Netherlands Court of Audit. We are very grateful to Dirk Jan van den Berg and Pieter Duisenberg for all the knowledge and experience they have shared with us over the years and the inspiration they gave us in carrying out our tasks. Tim van der Hagen joined the Supervisory Board on 1 April 2023 and has, since the resignation of Pieter Duisenberg, been serving as acting Chair of the Supervisory Board until a new Chair can be appointed. Carolina Wielinga was appointed for a second four-year term at the General Meeting held on 29 March 2023. For personal details of the members of the Supervisory Board see Additional information. For information on the independence of the members of the Supervisory Board see the beginning of this Governance section.

The Supervisory Board met seven times in 2023 (in person and online). In addition, one plenary meeting was held with the full Supervisory Board and Works Council. Individual Supervisory Board members also attended consultative meetings of the Works Council. In addition to each member’s own individual continuing professional education activities, the Executive Board and Supervisory Board also organise a number of joint sessions each year. Deep-dive sessions were held in 2023 on artificial intelligence and on including broad prosperity values in decision-making.

| Attendance at SB and committee meetings | SB | AC | BBC | Note |

|---|---|---|---|---|

| Pieter Duisenberg | 4 out of 4 | 4 out of 4 | date of resignation 1 October 2023 | |

| Dirk Jan van den Berg | 1 out of 2 | 1 out of 2 | date of resignation 29 March 2023 | |

| Tim van der Hagen | 5 out of 5 | 3 out of 3 | date of first appointment 1 April 2023 | |

| Johannes Meier | 7 out of 7 | 5 out of 5 | ||

| Anja Mutsaers | 7 out of 7 | 5 out of 5 | ||

| Ate Visser | 7 out of 7 | 5 out of 5 | ||

| Carolina Wielinga | 7 out of 7 | 5 out of 5 |

Remuneration, Selection & Appointment Committee

Members: Anja Mutsaers (Chair), Dirk Jan van den Berg (up to March 2023), Pieter Duisenberg (up to October 2023), Tim van der Hagen (from 1 April 2023)

The Remuneration, Selection & Appointment Committee (RSAC) held five online meetings in 2023 to discuss regular items, such as the achievement of the targets for the purpose of determining the Executive Board’s variable remuneration for 2022, the adoption of new quantitative and qualitative targets for variable remuneration for the Executive Board for 2023, and the remuneration section of the annual report with regard to 2022. Members of the committee also spent considerable time during the year on the recruitment process to find candidates to succeed Han Fennema, Pieter Duisenberg and Dirk Jan van den Berg. The RSAC’s deliberations and findings are reported in the plenary meetings of the Supervisory Board. The committee’s meeting documents and minutes are made available to all Supervisory Board members.

We have the role of employer with respect to the members of the Executive Board according to the articles of association, and we are also responsible for a well-functioning Executive Board in general. Members of the RSAC periodically conduct formal performance reviews with all members of the Executive Board, most recently in January 2024. In addition, regular informal discussions take place between individual members of the Supervisory Board and the Executive Board, and from our extensive contact with the Executive Board members, as well as with the Works Council and other parties inside and outside the company, we have plenty of other input for forming an opinion on how the Executive Board manages the business.

The outcomes of the annual evaluation have a major impact on the amount of the variable remuneration to be paid out. In our view, this is consistent with the importance of achieving the company’s long-term objectives, as well as with matters like safety, security of supply and corporate social responsibility, matters that are essential for Gasunie retaining its social licence to operate. The variable remuneration to be paid is determined by the full board on the advice of the RSAC.

Audit Committee

Members: Carolina Wielinga (Chair), Ate Visser, Johannes Meier

The Audit Committee (AC) met five times in 2023. The regular meetings were not only attended by AC members, but also by the CFO, the internal auditor, the external auditor and the group controller. In addition, the committee met with the external auditor and the internal auditor without management being present.

The agenda included recurring items like the regular internal and external financial reports, the corporate business plan, taxation, financing, profit appropriation and dividend, the regular reports of the internal auditor and setting their audit programme, the external auditor’s audit plan, the 2022 annual report, including the financial statements for 2022, the management letter and the auditor’s report, the Executive Board’s Document of Representation, the risk matrix and the control of the main risks, developments in IT and the organisation, and the effectiveness of security to ensure safe and reliable gas transmission. The AC is monitoring the implementation of the ERP (enterprise resource planning) software package SAP S/4HANA as a special project. In 2023, EY took over the audit engagement from PwC.

Prior to the AC meetings, the Chair of the Audit Committee always talks directly with the external auditor, usually in the presence of the CFO. The discussions and findings of the AC are reported in the plenary meetings of the Supervisory Board. The committee’s meeting documents and minutes are made available to all Supervisory Board members.

A word of thanks

The Supervisory Board is proud of the flexibility and decisiveness Gasunie has shown in carrying out the numerous and varied activities this year, both for security of supply and for the climate objectives and targets, and of the enormous steps forward the company has taken in realising its Vision 2030 plans and projects. We would like to extend our heartfelt thanks to everyone in the company.

Groningen, 29 February 2024

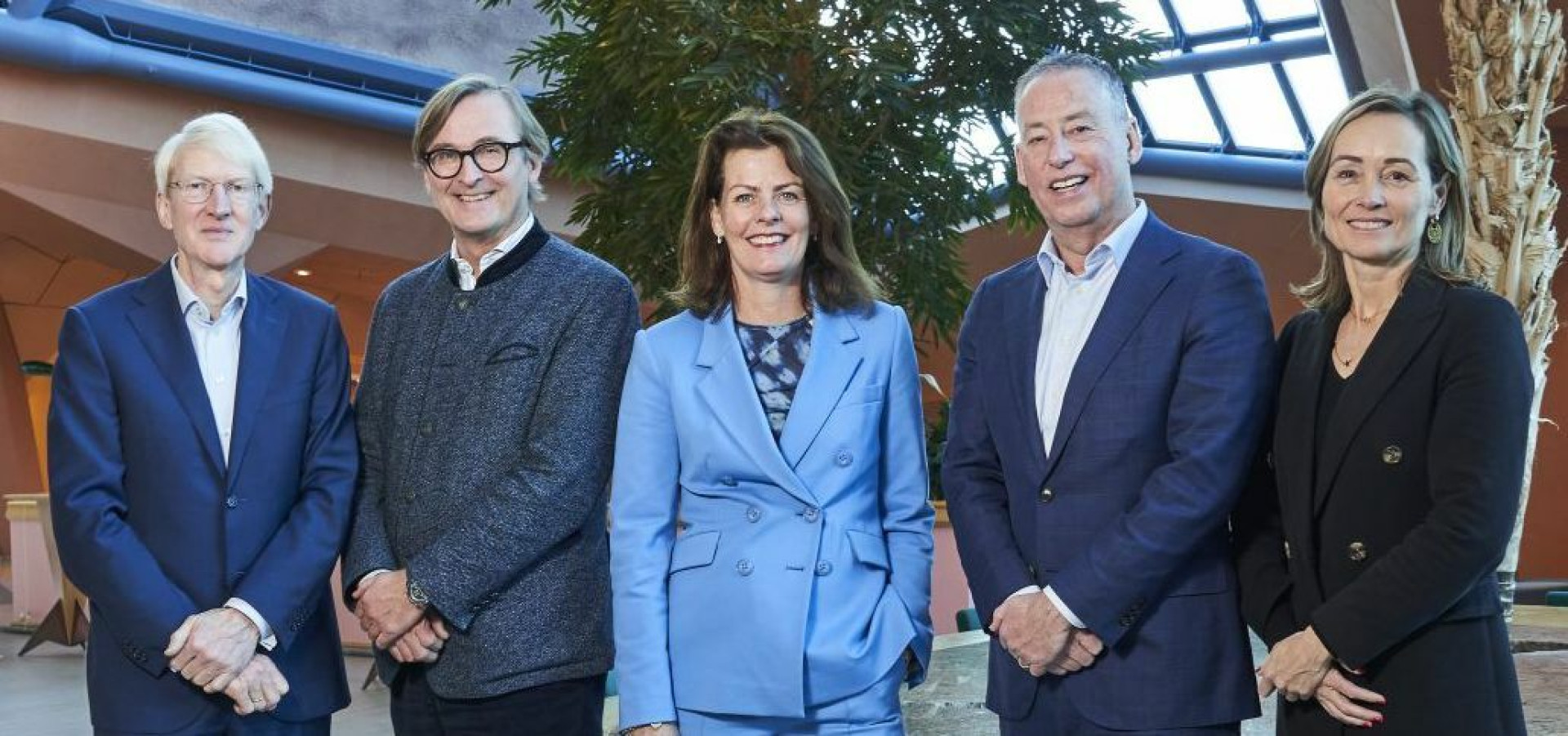

Supervisory Board of N.V. Nederlandse Gasunie

Tim van der Hagen, (interim) Chair

Johannes Meier

Anja Mutsaers

Ate Visser

Carolina Wielinga

Remuneration Report

Remuneration policy for the Executive Board

The remuneration policy was adopted by the Annual General Meeting on 14 July 2021, as proposed by the Supervisory Board, with due account taken of the recommendation of the Remuneration, Selection and Appointment Committee. No changes were made to the remuneration policy compared to previous years.

Aims and principles underlying the remuneration policy

The aim of the remuneration policy is to attract, motivate and retain Executive Board members of the right quality and with the right experience, both from within the company and in the form of proven talent from the market. The remuneration reflects the responsibility borne by the members of the Executive Board, and is considered in the light of the applicable remuneration principles in the market (as explained below). Gasunie needs this managerial talent to achieve its strategic objectives. This policy is implemented based on the following considerations:

In principle, having the Dutch State as the sole shareholder, Gasunie applies the same criteria that are applied to the remuneration policy in state-owned companies. If the Supervisory Board feels that this may lead to unacceptable risks for the company, it will consult with the shareholder.

For the remuneration package of members of the Executive Board, Gasunie uses a market comparison using peer group benchmarking. This peer group comprises public, semi-public, private and international companies that are sufficiently comparable to Gasunie, both in terms of size (number of employees, assets and revenue) and in terms of operations. The comparison mainly includes companies from the energy, distribution, installation, construction, and engineering consultancy sectors.

The structure of the remuneration of members of the Executive Board is determined on the basis of market comparisons that also take into account the pay ratios within the company, thus creating a logically continuing salary line from the posts in the Executive Board to the posts under the Executive Board.

Application of the variable remuneration policy depends on the achievement of short and long-term targets with respect to operational and strategic performance.

Remuneration structure

The remuneration consists of:

- a fixed component (annual basic salary)

- a variable component, dependent on the attainment of both short and long-term targets, as specified in the texts below

- the employer’s payment towards the pension contribution

- other secondary employment conditions

Annual basic salary

When appointing members of the Executive Board, the Supervisory Board will limit the sum of the fixed and variable annual salary on appointment to a maximum of € 397,205 (2021 level) for the Chair of the Executive Board. The Supervisory Board decides on the level of annual salary increments. If the maximum salary has been reached, further growth is limited to the across-the-board increments laid down in the collective labour agreement.

Variable remuneration

The variable remuneration is based on the remuneration policy that has been approved by the shareholder. The maximum variable remuneration is 20% of the annual basic salary. The targets that must be attained in order to qualify for variable remuneration are agreed annually. These must be ambitious and reflect the company’s strategy focused on long-term value creation. The achievement of the objectives is determined on a discretionary basis, taking into account all circumstances and developments over the past year.

The Supervisory Board is authorised to adjust the variable component within the limits mentioned above if it is likely to lead to unfair outcomes due to exceptional circumstances during the performance period. The Supervisory Board is also authorised to reclaim from members of the Executive Board a variable bonus that was awarded on the basis of inaccurate financial or other data or ‘incorrect conduct’.

The Supervisory Board has chosen performance criteria that relate to the implementation of Gasunie’s strategic goals, both for the short and the long term. In defining the company’s strategy, the social function of Gasunie’s activities and their effects on society are explicitly taken into account. Performance criteria have therefore also been defined, relating to safety and transmission security.

The variable remuneration elements are divided over five targets, each with a weighting of 4%. Four regular targets relate to achieving Gasunie’s business objectives in a safe, affordable and reliable manner, and to significantly advancing the company in achieving its long-term strategic objectives. Each year, the Supervisory Board sets a specific fifth target that focuses on a topic concerning which extra attention is requested in that year. For 2023, this involved improving risk analyses and the collaboration with third parties.

Reasoning behind variable remuneration

The Supervisory Board set the variable remuneration of the Executive Board for the year 2023 at 16%. The Remuneration & Selection/Appointment Committee advised on the achievement of the targets and the quantitative elements were verified by the internal auditor.

Gasunie had a successful year in 2023 and performed well to excellently in many respects. Management and employees showed agility and worked tirelessly for both energy transition and security of supply for northwest Europe. Significant progress was made on the energy transition with, among other things, final investment decisions for the Porthos project and the hydrogen backbone and the further development of Aramis and CO2Next. Security of supply was further strengthened with, among other things, the expansion of Gate terminal and the commissioning of EemsEnergyTerminal. On the regulatory front, GTS was vindicated by the CBb's ruling on the Method Decision.

On the other hand, not everything went well. The construction of Zuidbroek II was further delayed, safety performance fell short of target, Gasunie did not meet targets on all elements and there were problems in the execution of some projects. This results in not awarding all points for the Operational Excellence, Business Expansion and Review governance process and project guidelines elements.

This results in the following award of variable remuneration:

| Mr J.J. Fennema | Ms J. Hermes | Mr U. Vermeulen | Mr B.J. Hoevers | Mr J.A.F. Coenen | ||

|---|---|---|---|---|---|---|

| Maximum | Realisation | Realisation | Realisation | Realisation | Realisation | |

| Elements | ||||||

| 1. Operational Excellence | 4.00% | 2.00% | 2.00% | 2.00% | 2.00% | |

| 2. Business Expansion | 4.00% | 3.00% | 3.00% | 3.00% | 3.00% | |

| 3. Development of the organization | 4.00% | 4.00% | 4.00% | 4.00% | 4.00% | |

| 4. Positioning of (natural) gas and GU | 4.00% | 4.00% | 4.00% | 4.00% | 4.00% | |

| 5. Improving risk analyses, collaboration with third parties | 4.00% | 3.00% | 3.00% | 3.00% | 3.00% | |

| Total | 20.00% | 17.00% | 16.00% | 16.00% | 16.00% | 16.00% |

| Achievement percentage | 85.00% | 80.00% | 80.00% | 80.00% | 80.00% | |

| Variable remuneration paid | € 54,044 | € 54,934 | € 24,415 | € 48,831 | € 33,600 |

Payment of the variable remuneration takes place after adoption by the shareholders' meeting.

Pension

The Gasunie pension plan applies to members of the Executive Board. This is based on average pay and includes a personal contribution from the members of the Executive Board in accordance with the rules that also apply to other Gasunie employees.

Other secondary employment conditions

Gasunie has put together a package of secondary employment conditions for its Executive Board members, which also applies to other staff.

Other conditions

Term of service

Members of the Executive Board are appointed for a period of four years, with the possibility of extension by four years. The members of the Executive Board under the articles of association have an employment contract with Gasunie for the same duration as their term of service. Their employment contract therefore ends automatically if they are not reappointed.

Notice period

Members of the Executive Board must provide three months’ notice of termination of their employment contract; for the company, a notice period of six months applies.

Severance pay

Severance pay for Executive Board members will be limited to a maximum of one year’s basic salary (i.e. the fixed part of the remuneration), in accordance with the Dutch Corporate Governance Code. This compensation also includes any transition compensation. In principle, no severance pay is granted if a member of the Executive Board is not reappointed; a proposal from the Supervisory Board to deviate from this principle requires the approval of the shareholder.

Change of control

Executive Board members are covered by a ‘change of control’ clause, which states that if they are forced to leave the company due to a merger with, or the acquisition of the company by, an external party, or in the event of a fundamental change in the nature, management or structure of the company that is beyond the control of the Executive Board, they will be awarded compensation up to a maximum of one year’s basic salary (i.e. the fixed part of the remuneration), regardless of which party terminates the employment contract.

Remuneration package for 2023

Based on the policy outlined above, the Supervisory Board granted the following annual basic salaries and variable bonuses for members of the Executive Board*.

| In euros | Annual basic salary in 2023 | Variable remuneration (for performance in 2023) |

|---|---|---|

| Mr J.J. Fennema | 317,907 | 54,044 |

| Ms J. Hermes | 343,340 | 54,934 |

| Mr U. Vermeulen | 152,595 | 24,415 |

| Mr B.J. Hoevers | 305,191 | 48,831 |

| Mr J.A.F. Coenen | 210,000 | 33,600 |

* Han Fennema left Gasunie on 1 November 2023.

Pay ratio

The pay ratio at Gasunie is 4.18. This is the ratio between the total remuneration of the highest paid employee and the median of the total remuneration of all other employees in the Netherlands. The total remuneration is based on the sum of the annual taxable pay and the pension costs (employer’s contribution). In calculating the median, only those employees are taken into account who were employed for the entire year. In 2023, the median total remuneration of all Gasunie employees in the Netherlands increased by 14.76%. The remuneration of the highest paid employee increased by 14.5% in 2023.

Declaration by the Executive Board

Corporate governance statement

The information to be included in this Corporate Governance Statement as described in the Decree on the contents of the management report is included in this annual report. Information on the main features of the management and control system and the diversity policy regarding the composition of the Management Board and the Supervisory Board, as required by Article 3a (a) and (d), is included in the Governance section.

In Control Statement

With reference to best practice provision 1.4.3. of the Dutch 2022 Corporate Governance Code, the Executive Board declares that:

- the report provides sufficient insight into any failings in the effectiveness of the internal risk management and control systems with regard to, in any case, the strategic, operational, compliance and reporting risks (best practice provision 1.2.1); this is set out in the Governance section and in the Supplementary Information section Risk Management General;

- the aforementioned systems provide reasonable assurance that the financial reporting does not contain any material misstatements;

- based on the current state of affairs, it is justified that the financial reporting be prepared on a going concern basis; and

- the report states the material risks, as referred to in best practice provision 1.2.1, and the uncertainties, to the extent that they are relevant to the expectation of the company’s continuity for the period of twelve months after preparation of the report.

The Executive Board,

Ms J. Hermes*, (interim) Chair

Mr B.J. Hoevers

Mr J.A.F. Coenen

Groningen, 29 February 2024

* Director under the articles of association